Introduction

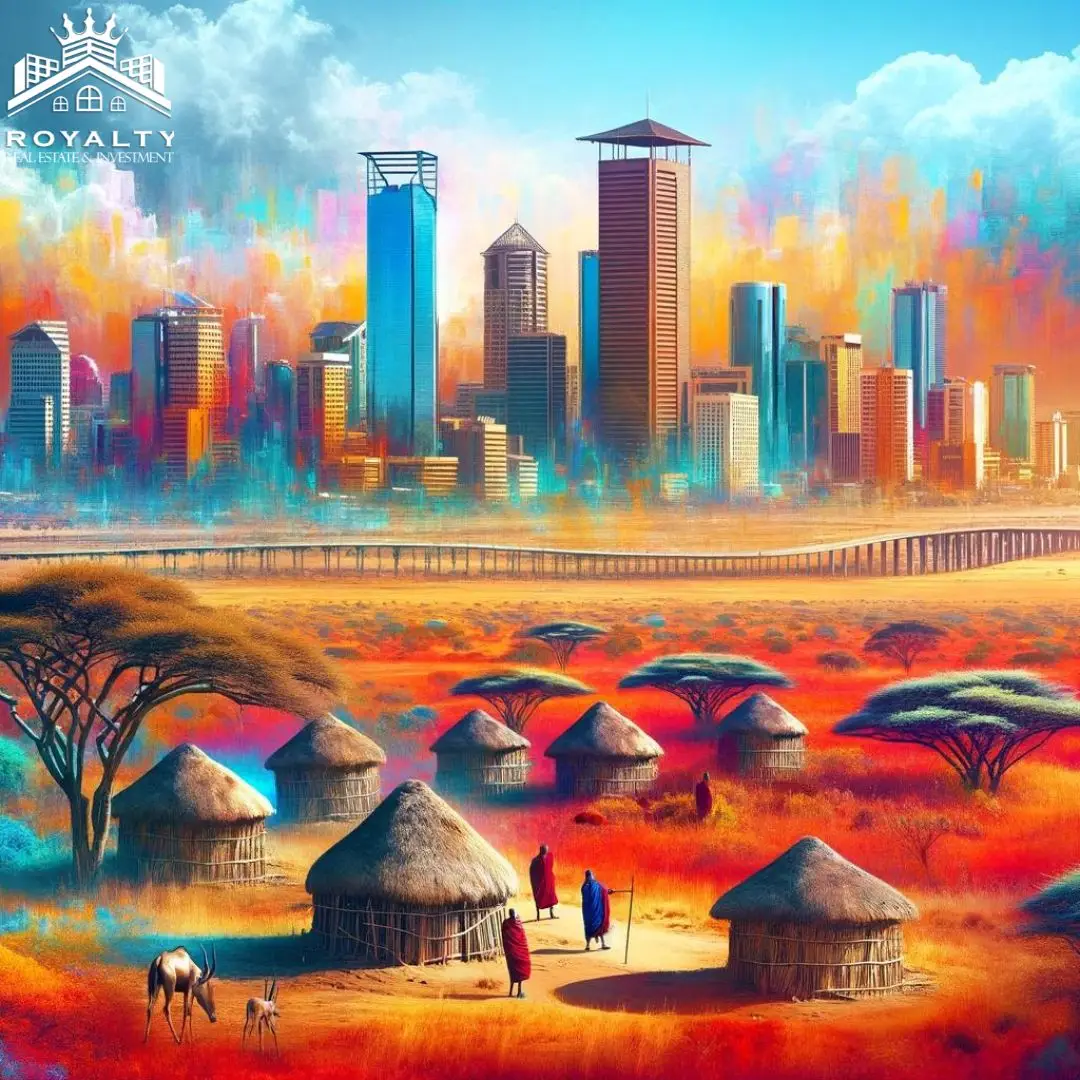

Have you ever dreamt of owning a piece of the majestic landscapes in Kenya, where the savannah meets the city skyline? Investing in Kenyan real estate can be an exhilarating venture for foreigners.

But, as with any international investment, it’s crucial to tread carefully and understand the terrain. This guide will walk you through understanding the market dynamics, legal frameworks, financial considerations, and the cultural nuances of real estate investments in Kenya.

Understanding Kenya’s Real Estate Market

Current trends and growth areas in Kenyan real estate

Kenya’s real estate market is as dynamic as it is diverse, with developments burgeoning especially in urban and peri-urban areas.

In recent years, there has been a significant boost in infrastructure development, making the property market in cities like Nairobi, Mombasa, and Kisumu ripe for investment.

The demand for both residential and commercial properties is climbing, fueled by a growing middle class and enhanced connectivity.

Legal Framework for Foreign Investors

Overview of property ownership rights in Kenya for foreigners

Foreigners can hold property in Kenya through leasehold tenure, typically up to 99 years. This means while you can own the structures and developments on the land, the land itself remains leased from the government.

Key laws and regulations affecting foreign real estate investment

Understanding the Kenyan legal system is key. Familiarize yourself with the Land Registration Act, the Physical Planning Act, and guidelines by the National Land Commission.

These form the backbone of real estate law governing land ownership and development.

Restrictions and limitations on foreign ownership

Foreigners are restricted from buying agricultural land in Kenya, which is reserved for Kenyan citizens.

This highlights the importance of confirming land use classifications and zoning restrictions before investing.

Steps to Investing in Kenyan Real Estate

Finding a property

Employ reputable real estate agents who have a deep understanding of the local market.

Ensure they are registered under the Estate Agents Registration Board.

Due diligence

- Check for title deeds: Verify their authenticity and ensure they are registered in the seller’s name.

- Encumbrances: Look for any claims or liens against the property that may hinder your ownership.

Navigating the purchase process

The process typically follows these steps: negotiating terms, drafting and signing a sales agreement, paying a deposit, and finally transferring ownership.

Each step should be handled with the assistance of your lawyer and real estate agent.

Financial Considerations

Overview of taxes applicable to real estate purchases and ownership in Kenya

Be aware of stamp duty, property taxes, and potential capital gains tax. The rates may vary based on the property value and location.

Financing options for foreigners

Some Kenyan banks do offer mortgage products for foreigners, but often at higher interest rates. Exploring various financing options is advisable to find the most feasible plan.

Currency regulations

There are stringent regulations governing the repatriation of funds. Ensure you understand these restrictions to plan your financial transactions effectively.

Role of Local Professionals

Importance of working with Kenyan real estate agents, lawyers, and other professionals

From navigating local regulations to closing deals, seasoned professionals are indispensable.

They provide insights and foresight that can safeguard your investment.

How to choose the right partners and advisors

Opt for professionals with a robust track record and those recommended by fellow investors. Transparency and communication are key traits to look out for.

Cultural Insights and Practical Tips

Understanding local business culture and practices

In Kenya, relationship-building is crucial in business dealings. Patience and respect go a long way in fostering essential business connections.

Tips on negotiating and closing deals in Kenya

Flexibility and understanding of the local market rates are essential for negotiation. Be prepared to engage in back-and-forth discussions amiably.

Case Studies and Success Stories

Hear from those who’ve successfully navigated the market. For instance, a European investor expanded into the retail property sector in Nairobi, adapting to the shopping mall culture, which has seen significant growth in urban Kenya.

Future Outlook and Opportunities

Emerging areas and future trends

Keep an eye on counties like Nakuru and Nyandarua, which are becoming increasingly popular due to their strategic locations and developmental projects.

Conclusion

Investing in Kenyan real estate holds promising prospects, but comes with its set of challenges.

With the right approach, information, and local assistance, you can make well-informed decisions that yield substantial benefits.

Dive in with caution, and embrace the vibrant real estate opportunities Kenya has to offer!